In response to what I posted earlier to that online group, someone from Croatia

Hi Mark,

situation in Japan

Here is what I responded (slightly edited):

_____,

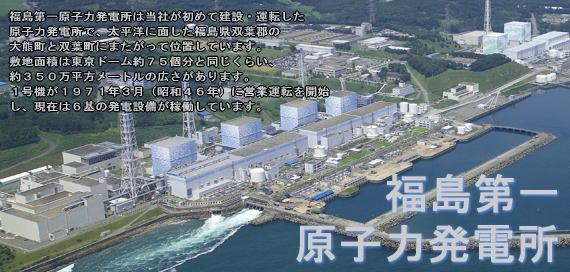

I think it is still too early to tell how great the impact of the events in Japan will be on Southeast Europe ’s economy and the energy sector in the short (1 year) term. As of this date the information that is being published seems to indicate that a corner has been turned at Fukushima Daiichi, that perhaps all 5 of the charged reactors (unit 4 was emptly at the time of the quake) and all 7 spent-fuel pools there are cooling down. I have my doubts about the veracity of this, but that is the gist of the Japanese news. (The most frequent reports – though rather dry and devoid of any colorful detail – can be found at “TEPCO 福島第一原子力発電所 プレスリリース-ホームページ掲載情報” at http://www.tepco.co.jp/nu/f1-np/press_f1/2010/2010-j.html, and much of the same information can be found in English at the IAEA’s “Fukushima Nuclear Accident Update Log” at http://www.iaea.org/newscenter/news/tsunamiupdate01.html.) As for my own thoughts on the safety record of Japan’s nuclear industry, based in part on my experience working as an engineer for a couple of Japanese companies, see my recent blog entry “What I Wrote in October 2010 about the Poor Safety Record of Japan’s Nuclear Power Industry”.

Last week, when the roofs of the reactors were exploding and people were just beginning to talk about soaring temperatures in the spent-fuel pools, it seemed like the much-touted “nuclear renaissance” was over. At that point any talk of moving forward on Cernavoda 3 & 4 (Romania), Belene 1 & 2 (Bulgaria), Paks 5 & 6 (Hungary), Krško 2 (Slovenia), as well as the 8 nuclear plants that Berlusconi’s administration wants to build in Italy (one of the 45 sites under consideration for which is readily visible from my apartment window) seemed absurd. (See http://www.world-nuclear.org/info/inf17.html for information on proposed nuclear plants.) But if the situation at Fukushima Daiichi stabilizes, and they are able to remove bad nuclear news from Japan U.S.A.

Any forward movement on these nuclear projects, obviously, would not lead within one year to any increase in nuclear TWh generated. But the idea that dozens of GW of new nuclear production might be in the pipeline could discourage those who are considering investing in other large energy projects (such as oil & gas pipelines, or coal-fired power plants). Also, we seem to be seeing in Italy that the big business lobby (Enel and the big-business-oriented chamber “Confindustria”) is trying to get the government to reduce its support to renewable energy sources so as to free up more money for nuclear energy (which is low-carbon, though not renewable).

That is the direct impact of the nuclear safety side of the recent events in Japan

“In this issue, we anticipate that the sudden shock experienced by the Japanese economy will lead not only to the halt in US T-Bond purchases by Japan, but it will force the authorities in Tokyo to make substantial sales of a significant portion of their US Treasury Bond reserves to finance the enormous cost of stabilization, reconstruction and revival of the Japanese economy.”

The article maintains that the Japanese earthquake crisis will boost inflation worldwide, although they base a portion of the expected inflationary effect on the hypothesis that the Fukushima Daiichi situation – which at that time was rapidly worsening – will lead to a complete abandonment of nuclear construction plans worldwide, and a resulting long-term increase in the price of oil.

I had not yet heard of the Japan

The Tragic Failure of "Post-Communism" in Eastern Europe

by Dr. Rossen Vassilev

Bond Market Anticipates Greek Default

by Mike Shedlock

The first of these would seem to augur the possibility of complete political and economic disruption in Eastern Europe (including, to a lesser extent, former Yugoslavia) if the present U.S. financial meltdown, with the Fed’s resulting policy of monetizing the U.S. debt, continues to lead to an outflow of U.S. funds to world markets and a further rise in commodity prices (including oil and foodstuffs) such as has already sparked unrest in Tunisia, Egypt, Bahrain, etc.

The second article indicates what many analysts have been saying for a while: the global recession (“crisis”) is not over, but the vast debts of the private sector (banks) have simply been taken on by the public sector (governments), and the public sector worldwide is now no longer able to support that level of debt. So we can expect sovereign defaults in a number of countries, such as Greece , Ireland , Portugal , and Japan Japan Japan guarantee that it will remain high, while the events in Libya

All in all, I think that the events in Japan will have the following effects on energy and the economy in general in Southeast Europe over the next twelve months:

1) Continuing upward pressure on all commodity prices, which should lead to economic slowdown, but also upward pressure on the price of oil, which should encourage investment in other sources of energy.

2) Higher inflation worldwide, which will lead to economic slowdown, sovereign defaults, and political unrest, which will all lead to further economic slowdown.

After posting the above to that group yesterday, this morning I ran across the following excellent article by James Quinn about the economic effects – in Japan and globally – of the earthquake and tsunami in Japan:

Tsunami Accelerates Japan's Economic Meltdown Driven by Debt and Demographics

by James Quinn

http://www.marketoracle.co.uk/Article27101.html

A couple of excerpts:

“Japan Japan Toyota

“Japan Japan

The Bank of Japan will follow the same script as Ben Bernanke. They will print new Yen and buy the newly issued debt. What an original idea. Japan Japan America

The Japanese own $886 billion of US Treasuries and have bought $256 billion of our debt since October 2008. Timmy Geithner will need to issue $1.5 trillion of new bonds per year. Japan U.S. Japan Japan and the U.S.

No comments:

Post a Comment